The national debt is too often framed as a partisan talking point—one side decrying excessive spending, the other warning that austerity will cripple the economy. In reality, this is first and foremost a math problem. As one note-on-budgeting puts it, “rapidly mounting deficits could undermine U.S. economic growth, restrict government spending on important programs, and raise the likelihood of financial crises.”

What’s needed is a centrist, durable framework: a Fiscal Responsibility Pact that pairs disciplined long-term spending limits with smart tax reform and growth incentives. This approach does not mean austerity in its harshest sense, but rather targeted discipline, shared sacrifice, and the structural reform required to lay the groundwork for generational stability.

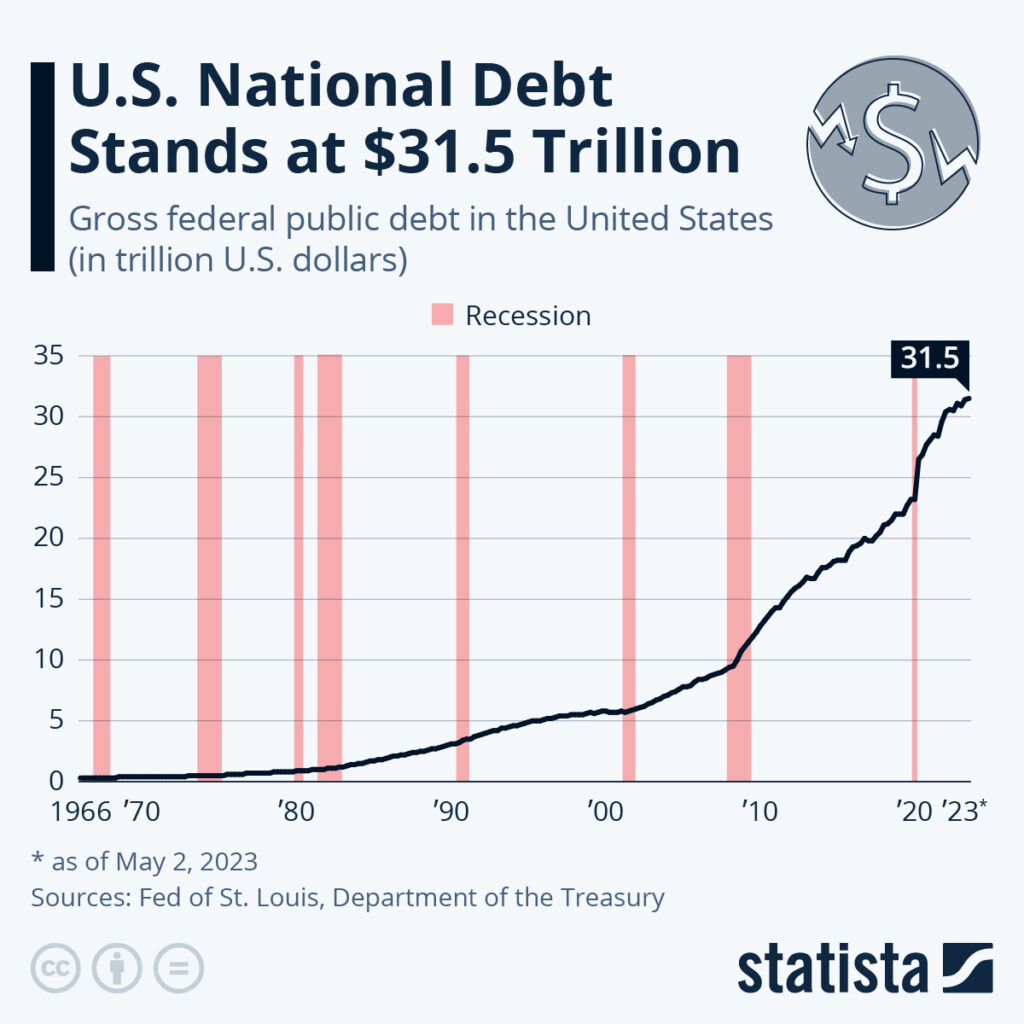

The Stakes Are Clear

The size of the challenge is unmistakable. A recent analysis by the CBO projects that under current law and interest-rate assumptions, the U.S. federal debt held by the public could exceed 165% of GDP over the next three decades and potentially rise as high as 300% if interest rates remain elevated and policies aren’t adjusted.

Another non-partisan source shows that fiscal year 2025 began with a deficit of roughly $2 trillion by August, with revenues up around 7% but outlays rising about 5% year‐over‐year.

These are not simply numbers on a ledger. They reflect risks to economic growth, generational equity, and national flexibility.

Yet the problem is seldom about which party spends more, and more about how we structure fiscal policy. A recent paper argued that a better budget control act could reduce deficit spending by $8 trillion over ten years and stabilize the debt share of GDP, but only if combined with reforms to mandatory programs and tax policy.

This is where centrist policy shines: the goal is not austerity for austerity’s sake, but prudent structural reform that preserves vital functions, encourages growth, and shares responsibility across time and parties.

A Pact Built on Three Pillars

A working Fiscal Responsibility Pact would rest on three interlocking pillars:

1. Long-Term Spending Discipline

Instead of across-the-board cuts, the pact would set binding phases for major categories: discretionary spending caps (defense, education, infrastructure), reform of entitlement growth (targeting growth rates in Social Security/Medicare), and mandatory review mechanisms every 5–10 years. The idea is to enforce moderation, not mini-crises.

Non-partisan analyses suggest such mechanisms can curb the growth of deficits without triggering recessionary austerity. The 2011 Budget Control Act, for example, set future caps that spurred bipartisan compromise instead of unilateral austerity.

2. Smart Tax Reform

Caps alone won’t suffice. If revenues stagnate while spending rises, the ratio of debt to GDP keeps climbing. Reform must include broadening the tax base, eliminating inefficient deductions, and ensuring tax policy supports growth.

One blog summarizes this plainly: “Rapidly mounting deficits could undermine U.S. growth unless lawmakers make politically difficult decisions to curb spending, raise taxes, or both.”

The centrist middle recognizes that tax increases should be calibrated – not ideology-driven – but set to align with spending commitments and growth ambitions.

3. Growth Incentives & Reform

Debt is manageable only if the economy grows faster than interest and spending growth. That means investing in human capital, infrastructure, research and development, and competition policy. At the same time, regulatory reform and sector-specific incentives, particularly around workforce, innovation, and productive, are essential.

A centrist pact emphasizes that smart growth is not optional. It’s the lever that makes discipline sustainable and avoids a future where debt service crowds out everything else.

Learning from the 1990s

In the mid-1990s the United States experienced a rare moment of bipartisan fiscal success. Lower deficits, rising growth, and falling debt-to-GDP ratios were achieved through a combination of tax increases (1993), welfare reform (1996), and discretionary spending discipline. While not a perfect model, this era offers a template: bipartisan agreement, structural reform, and growth orientation.

One moderate commentary put it this way:

“If we can’t get members of Congress to put aside their ultra-partisanship and pull together rather than apart, we face the most predictable economic crisis in history.”

The key lesson: the center can deliver stability – not by radical cuts or unchecked expansion, but by combining modest sacrifice with long-term vision.

Why a Centrist Approach Matters

When debt becomes a partisan rallying cry, the risk is high for gridlock or half-measures. Extremes either demand deep cuts that spark recession or advocate perpetual borrowing that erodes generational equity. A centrist pact avoids both traps.

It ensures:

- Resilience: Fiscal rules that survive electoral shifts if both parties buy in.

- Credibility: Markets and global partners respond better when there is bipartisan resolve.

- Inter-generational fairness: Avoiding the scenario where future taxpayers bear the brunt of today’s decisions.

- Flexibility: Safeguards that allow responsive policy when crises hit.

A recent backgrounder notes the U.S. risks losing its “option value” if debt crowds out investment.

Today, with interest rates much higher than in the 1990s, and demographic headwinds stronger, that risk is more severe—and so the need for a centrist, serious fiscal pact is more profound.

Roadblocks, but Not Road-Blocks

Implementing a pact will encounter political and practical challenges:

- Localized interests opposing benefits cuts or tax reforms.

- Voters disliking the language of “sacrifice,” even when reform is targeted and growth-oriented.

- Short electoral cycles versus long-term fiscal horizons.

- Interest-rate and cost pressures creating “balloon risks” if reforms delay too long.

Yet these challenges don’t amount to impossibility. Rather, they highlight why centrist governance matters because granular, evidence-based policy is harder to anchor in shouting headlines.

Research shows that delay increases costs. A 2024 study in Public Budgeting & Finance found that the longer governments postpone fiscal consolidation, the more painful the necessary adjustments become.

In other words: discipline now means more options later.

From Concept to Action

What does an actionable pact look like? Consider:

- Five-year spending framework with automatic review triggers for any category exceeding X% of GDP.

- A tax-reform commission with bipartisan membership, tasked with delivering a base-broadening, growth-oriented tax proposal within 18 months.

- A growth-investment fund (infrastructure, R&D, workforce) tied to long-term returns and paired with a transparency dashboard for public accountability.

- Annual “fiscal sustainability reports” mandatory for Congress, showing debt-to-GDP, interest burden, and growth projections under multiple scenarios. Together, these build the architecture of discipline without austerity.

Conclusion

The fiscal challenge we face is not liberal or conservative. It is structural and bipartisan. A centrist Fiscal Responsibility Pact offers a pathway out of the impasse and recognizes that debt is a math problem, not simply a political one.

By combining disciplined spending, intelligent tax reform, and growth first policy, this approach preserve what Americans value: social mobility, economic security, and generational fairness.

The 1990s showed it is possible. The stakes today are higher. The choice: will policy become part of the problem or part of the solution? That is what centrist governance is for.

Let’s choose the latter.